Check your payslip is correct if you work through an umbrella company

CheckFind yourout paysliphow to makespot suresigns youof aredisguised notrenumeration involved in a tax avoidance scheme,on operatedyour bypayslip someand umbrellaget companies.

help and support.

Your responsibilities

Many umbrella companies follow the tax rules, but some do not.

Some Theseclaim companiesthat:

- their

maytaxtryarrangementstoorattracttaxyouavoidancebyschemesclaimingarethatHMRCyou’llapproved - you

bewillabletopay.pay

YouIf needan toumbrella understandcompany howtells you getthat paid,some toof makeyour sureemployment youincome areis not involvedtaxable, inthis acould taxbe avoidancea scheme.sign Checkof that your payslip includes all your income, and that tax and National Insurance have been correctly deducted.avoidance.

HMRC does not approve or endorse any umbrella companies or tax avoidance schemes.schemes You— you are responsible for your own tax affairs and making sure you pay the right amount of tax and National Insurance.

ReadWhile moreyou aboutcheck howyour andpayslip, whatyou you’llcan getalso paiduse whenthe workingHMRC throughtool to help you work out pay from an umbrella company.

What to look out for on your payslip

IfAs an employee working through an umbrella companycompany, paysyou need to know what to look out for on your payslip. This will help you morework thanout if you’re involved in a tax avoidance scheme.

Check your payslip has the amountcorrect:

- hourly

shownrate of pay - hours worked

- gross and net (take home) pay

- deductions from your salary

These can often look correct on your payslip, itso couldyou’ll also need to look for these on your reconciliation and pay statements.

Be aware that some deductions on your payslip might be agrouped signtogether. This can hide the true amount of tax avoidance.and National Insurance you’re paying.

PaymentsLook describedfor assigns loansof orextra expensespayments

YouLook mightout receive for:

- extra payments into your bank account

- text

andmessagesantellingemailtoconfirmhaveaboutreceivedaanseparate amount of money - payments

innotloans.processedThisthroughcouldPAYEbe— check your reconciliation statement, or asignpaymentofsenttaxtoavoidance.your bank account - a high umbrella company fee — look on your payslip to find this fee

These payments might be described as one of the following:as:

loanloansannuityannuitiesbonusbonuses- profit

shareshares - fiduciary

receiptreceipts - credit

facilityfacilities - capital

paymentpayments capitalpayadvanceadvances

SomeYour payslipspayslip will not may:

- show

allonly the paymentsmadepaidbythroughthePAYEumbrella—company,toparticularlymakewhereittheylookinvolvecompliantloan-typewithpayments.theYourtaxpaysliprules - not

mayshowonlyallshowthe paymentspaidmadethroughbyPAYE,thetoumbrellamakecompanyit—lookifcomplianttheywithinvolvethedifferenttaxtypesrules.of payments

You should lookalso outcheck:

- the renumeration section of your assignment contract

- your contract of employment for

anythese types of paymentsthat—haveasnottheybeenmaysubjectbetolegitimatePAYE.ifIftaxed

Look thefor an umbrella company tellsfee

Umbrella thatcompanies somecharge ofa yourmargin employment(fee) incomeeach istime notthey taxable,process thisyour couldpay beto acover signthe costs of taxusing avoidance.their services.

ForLook example,out yourfor payslipa mighthigh showumbrella non-taxablecompany payments,fee described(or asmargin). expenses,Umbrella evencompanies thoughthat youoperate havetax notavoidance claimedschemes anywill work-relatedoften expenses.charge higher fees than legitimate umbrella companies.

PayThis rates,fee loanshould amountsbe anddisclosed wayswhen inyou whichsigned umbrellayour companiescontract.

Check calculatefor thesethis willfee vary.on your:

If

- payslip

- reconciliation

you’restatement

- pay

charged fees

statement

IfThis you’remay chargedbe feestax byavoidance when:

- the

companyfee orpersonmarginsellingvaluetheisarrangementsimilarfortotheirtheservices,taxtheseorfeesNationalmayInsurancenotcontributionsalwaysyou should bevisiblepaying - the

onumbrellayourcompanypayslip.keepsTheyashouldmuchhavelargertoldmarginyouthanaboutotherthesecompanies - deductions

feesarewhengroupedyoutogethersignedon yourcontract.payslip

This fee does not contribute to your tax or National Insurance contributions payments.

You shouldcan compareask thesefor:

- a

feesbreakdownwithofotheryourcompanies,deductions tomakehelpsureyou understand what they’re for - a key information document if you’re working though an agency — this will provide you

arewithnotthepayingdeductionshigherandthanfees, your assignment and contract rates, and how they affect your gross and net pay

Check the normalpayslip fees.examples Thisto help you

Every payslip is different, but we have included some examples of what to look for on your payslip that could be a sign of tax avoidance.

Payslip examples

JoeYou iscan ause supplythe teacher ato 40-hourhelp weekyou andidentify isthe paidexample £14of perdisguised hour.remuneration Joetax worksavoidance, throughincluding ana umbrellasummary companyof forsome ancommon agency.key terms.

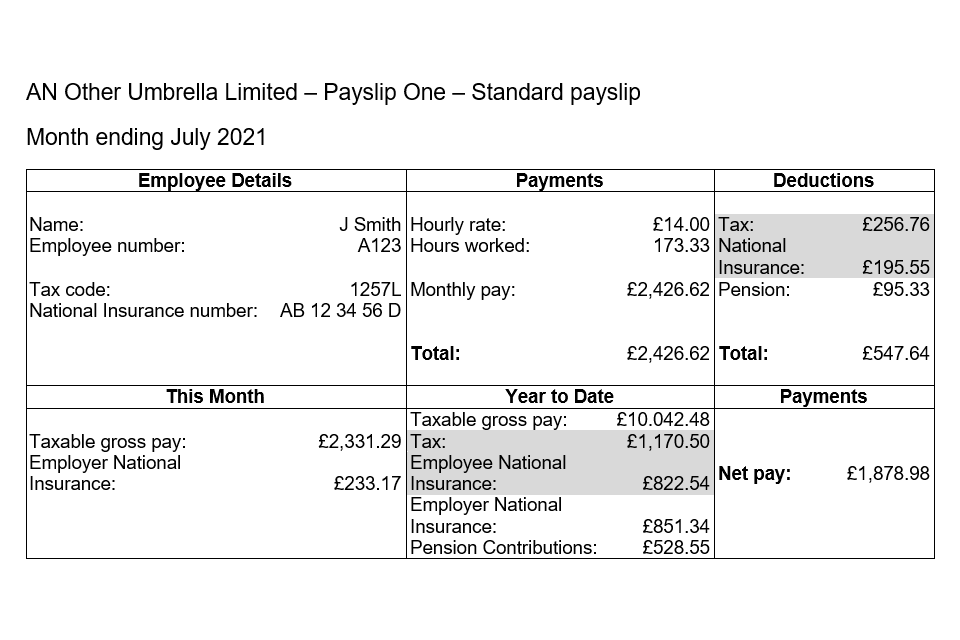

Example of a correct payslip

TheThis 2is examplesan example of payslipsthe forfigures you’d expect in the monthincome endingsection Julyon 2021a showcorrect differentweekly amountspayslip.

The oftable netshows paywhat (alsoyou’d knownsee asin take-homethe pay).income section.

Payslip

| Description | Rate | Units |

Amount |

|---|---|---|---|

| Basic |

£18.89 | 37 | £698.93 |

| Holiday |

0 | 0 | £84.16 |

| Total |

0 | 0 | £783.09 |

The hourly rate forof Joepay showsis on£18.89 payslipan 1hour as(reduced £14from an£25 hour.assignment Therate totaldue hoursto workedcompany showscosts 173.33and holiday pay).

You pay tax and National Insurance contributions on the total netgross paypay.

The table shows £1,878.98.what you’d see in the deductions section.

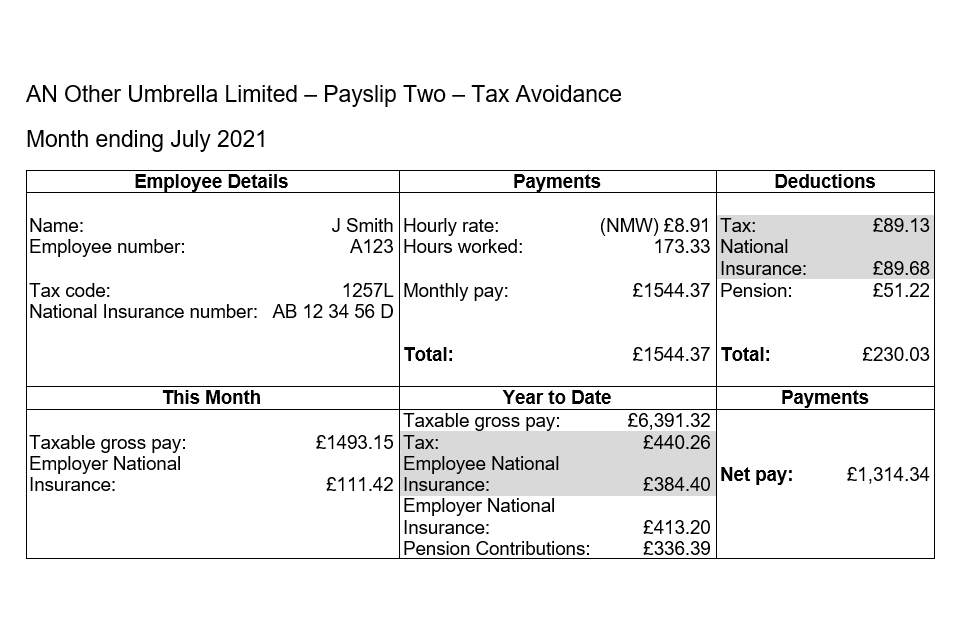

PayslipExample 2of — a payslip involving tax avoidance

TheIn hourlythis rateexample, formore Joemoney showswas onpaid payslipinto 2the bank account (an extra £204.29) than was shown as Nationalnet Minimumpay Wageon ratethe ofpayslip. £8.91This anis hour.a Theclear totalsign hoursof workedtax avoidance.

The table shows 173.33what andyou’d see in the totalincome netsection.

| Description | Rate | Units (hours) | Amount |

|---|---|---|---|

| Basic pay | £12.21 | 37 | £451.77 |

| Holiday |

0 | 0 | £54.53 |

Total  |

0 | 0 | £506.30 |

PayslipThe 2rate of pay is anthe exampleNational Living Wage (NLW) rate of what£12.21. couldThe bepayslip seenshows ifthat Joetax usedand aNational disguisedInsurance remunerationcontributions taxare avoidancepaid scheme.on the total gross pay.

What

The aretable theshows differenceswhat betweenyou’d see in the payslipsdeductions section.

| Description | Amount |

|---|---|

| PAYE (Tax) | £52.80 |

| National Insurance | £21.14 |

| Pension | £15.45 |

| Total deductions | £89.39 |

PayslipThe 2total differsdeductions of £89.39 are taken from payslipthe 1gross because:pay of £506.30 leaving a net pay of £416.91.

JoeThe

hascorrectbeenamountpaidofattaxtheand NationalMinimumInsuranceWagewasrate,takenwhichbasedgivesonhimtheagrosslowerpaynetshownpayJoe’sonemployerthehaspayslip.notTousedmakehistheactualpaysliphourlylook compliant, the employer used the NLW rate instead of£14theancorrecthourthe£25 hourly rate.- you pay less tax and National Insurance — the employer uses the lower NLW rate

- your gross pay is reduced lowering the amount of

£882.25,taxwhichand National Insurance taken - the extra payment of £204.29 is paid into your account but does not appear on

hisyour payslip

Why this payslip shows tax avoidance

The rest of Joe’sthe salary gets(an extra payment of £204.29 not shown on the payslip) was paid directly into histhe employee’s bank account aswithout any tax or National Insurance deductions.

This suggests a loandisguised remuneration tax avoidance scheme was used, because:

Both payslipsand showis not part of the correctPAYE amountcalculations of— tax and National Insurance contributionsmight havestill beenbe deducted,owed based on thethis grosshidden paypayment

The shown.extra However,payment forinto payslipyour 2,account Joecould usedeither be:

- paid separately

- combined with the £416.91 salary as a

disguisedsingleremunerationsalarytaxpayment

How avoidancethis scheme.affects Heyou

The paideffects lessof tax andavoidance Nationalmean:

- your

Insurancepensioncontributions,contributionsbecauseare less - the

loanemployerswaspensionnotcontributionsincludedareinless - your

PAYEfuturecalculations.pension payments will be less at retirement

TheWhat riskshappens ofif usingyou use a tax avoidance schemesscheme

Using an umbrella company that claims you’ll be able to take home a higher percentage of your pay is very risky.

If we find out that you’ve usedbeen using a tax avoidance scheme, you’llyou may be personally liable to pay:

- the tax and National Insurance contributions that are legally due

- interest on tax legally due

- any associated penalty

These payments are in addition to any fees that you have paid to those selling the scheme.

Due diligence

UseCheck oura toolslist to:

checkofiftheyounamedareatriskofworkoutwepayknowfromanumbrellacompany

HowGet tohelp reportand an umbrella companysupport

If you’re concerned about thea schemesscheme you’re currently using, you can:

- get independent professional tax advice

- contact HMRC by email: CAGetHelpOutOfTaxAvoidance@hmrc.gov.uk

You can also read guidance on the Money Helper website about understanding your payslip.

Reporting tax avoidance

You should report any tax avoidance arrangements to HMRC.

Add the reference ‘TAC’ when you describe the activity on the online form,form or give this reference when you call HMRC.call.

More information

Read

Updates moreto about:

yourthis rightpage

-

We have updated the

NationalguidanceLivingwithWagenew payslip andNationalreconciliationMinimumstatementWage theexamples.guidanceThisonwillpayslips,helponyouthecheckAcasifwebsite

Updatesyour topayslip thisis page

- a tax avoidance scheme.

-

A link to the tool 'work out pay from an umbrella company' has been added.