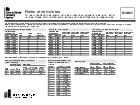

Vehicle tax rates (V149 and V149/1)

Rates of vehicle tax for all types of vehicle.

Documents

Details

TheV149 tableshas include standard rates forfor:

- cars

- motorcycles

- light goods vehicles

V149/1 thathas haverates alreadyfor:

- all

beenotherregisteredtypesandoffirstgoodsvehicleortaxvehicles - buses

- recovery vehicles

The rates are for newvehicles vehicles.that Theyhave alsobeen includeregistered. You can check tax rates for allnew typesunregistered ofcars goods vehicles, buses and recovery vehicles.online.

CalculateTax newyour car tax rates.vehicle

Go

Get Ultraan Lowaccessible -version ultra low emission vehicles that are free of the vehicle tax.tax rates.

Last updated

-

Linking to an accessible version of vehicle tax rates tables. Also linking to tax a vehicle service.

-

Old versions of the V149 and V149W PDFs removed.

-

Uploaded the latest accessible V149 and V149W PDFs.

-

Updated tax rates hyperlink.

-

Updated pdf (V149 1 April 2021)

-

Updated English and Welsh V149 pdf

-

Added new rates of vehicle tax from 1 April 2021 for cars, motorcycles, light goods vehicles and private light goods vehicles

-

New Welsh V149/1W added

-

Updated V149/1 pdf

-

Attached new V149/1 for 1 August 2020.

-

Update to Welsh pdf April 2020

-

Updated pdf.

-

New vehicle tax rates coming into force on 1 April 2020

-

Added the Welsh version of V149W for 2019

-

Attached new V149 for 1 April 2019.

-

Updated pdf.

-

Updated pdf.

-

Removed 2017 rates.

-

Updated with rates from 1 April 2018.

-

New rates of vehicle tax from 1 April, 2017

-

Old 2015 vehicle tax rates removed.

-

New vehicle tax rates from 1 April 2016 added.

-

The description has changed from first year rates to first vehicle tax rates.

-

New vehicle tax rates from 1 April 2015

-

Updated version of the V149 and V149W.

-

Go ultra low campaign link added.

-

Updated version of both th V149 and V149W.

-

Updated Version of the V149 published.

-

Updated version of the V149.

-

Added the V149W form

-

Added new V149 for 1 April 2014

-

First published.

Update history

2025-04-01 00:01

Removed outdated PDFs

2025-03-14 11:29

Added V149 and V149/1 PDFs

2024-04-01 02:00

Added new rates of vehicle tax from 1 April 2024 for cars, motorcycles, light goods vehicles and private light goods vehicles.

2023-08-02 10:19

Updated V149/1 added.

2023-04-04 10:00

Removed old vehicle tax rates for cars, motorcycles, light goods vehicles and private light goods vehicles

2023-03-27 17:00

Added new rates of vehicle tax from 1 April 2023 for cars, motorcycles, light goods vehicles and private light goods vehicles

2022-11-22 10:51

Linking to an accessible version of vehicle tax rates tables. Also linking to tax a vehicle service.

2022-04-01 00:00

Old versions of the V149 and V149W PDFs removed.

2022-03-25 00:00

Uploaded the latest accessible V149 and V149W PDFs.