How we are investigating the Vodafone/ThreeVodafone / Three potential merger

Why the CMACompetition and Markets Authority (CMA) is investigating the potential Vodafone/ThreeVodafone / Three merger and whatand what it might mean for consumers.

Why is the CMA investigating the Vodafone / Three potential merger?

The CompetitionCMA andinvestigates Marketsthe Authorityimpact (CMA)of hascertain startedpotential amergers detailedand Phaseassesses 2how investigationthey lookingcould intoimpact Vodafonecompetition UK’sin jointthe ventureUK. agreementThis withis Threeto UK.

Thepromote mergera wouldfair combineand thecompetitive companies’environment, where businesses and the UK telecommunicationseconomy operationsthrive, underand oneconsumers singlecan networkbe provider.

Bothconfident firmsthey haveare madegetting significantgreat investmentschoices inand theirfair networksdeals.

Competition incan recenthelp years,to includingkeep theprices rolloutlow, ofas 5G.well Threeas isprovide generallyan theimportant cheapestincentive offor thebusinesses 4to mobileimprove networktheir operators.services.

What we have found so far

TheIn CMAits launchedinitial ainvestigation formal(called investigationa into‘Phase the1 proposedinvestigation’) mergerwhich began in January 2024.

At2024, the endCMA found that the merger, which combines 2 of thisthe initial4 investigationmobile (callednetwork operators in the UK, could lead to a ‘Phasesubstantial 1lessening investigation’)of competition on the CMAbasis foundthat mobile customers might face higher prices and a reduction in quality.

This meant that a more detailed Phase(Phase 22) merger inquiry was required.

Provisional findings

ThisOn means13 September 2024, the CMA willpublished investigateprovisional findings on the impactPhase of2 thisinvestigation.

The potentialindependent mergerinquiry ongroup competitionhas inprovisionally concluded that:

- the

telecommunicationsmergersectorwouldinleadmoretodetail.ThepriceCMAincreaseswillforassesstenshowofthismillionspotentialofmergermobilebetweencustomers,rivalornetworksseecouldcustomers get a reduced service such as smaller data packages in their contracts - there are concerns that higher bills or reduced services would significantly impact

competitionthosebeforecustomersdecidingleastnextablesteps.Howtothisaffordmergermobilecouldservices - there are also significant concerns about the impact of the merger on the large number of consumers

Competitioncanwhohelpmight have tokeeppaypricesmorelow,forasimprovementswellin network quality that they don’t value - the deal could negatively impact ‘wholesale’ telecoms customers such as

provideSkyanMobileimportantandincentiveLebaraforwhich rely on the existing 4 network operators toimproveprovide theirservices,ownincludingmobile services - the deal would affect these wholesale customers by

investingreducinginavailable networkquality.operators to just 3, likely meaning they are less able to secure competitive terms and offer the best deals to retail customers

InAt itsthe initialsame investigation,time, the CMAmerger wascould concernedimprove the merger,quality whichof combinesmobile 2services and bring forward the deployment of next generation 5G networks and services. However, the 4CMA mobileconsiders networkthat:

- the

operatorsmergerinfirm would not necessarily have theUK,incentivegavetorisefollow through on its proposed investment programme after the merger - the CMA also has doubts as to whether those improvements, if delivered, would be as significant as claimed

As a realisticresult, prospectthe ofCMA has provisionally concluded that the deal is likely to lead to a substantial lessening of competition.competition Thisin couldthe meanUK.

What happens next?

It’s important to remember that mobilethese customersare faceprovisional higherfindings. pricesThe CMA will now publicly consult on its findings and reducedexplore quality,potential includingsolutions throughto lowerits investmentconcerns before reaching a final decision by mid-December. The CMA has set out potential solutions to Vodafone and Three in UKa mobileremedies networks.notice.

These range from legally binding ‘investment commitments’ overseen by the sector regulator and measures to protect both retail customers and customers in the wholesale market, to prohibiting the merger.

How merger investigations work

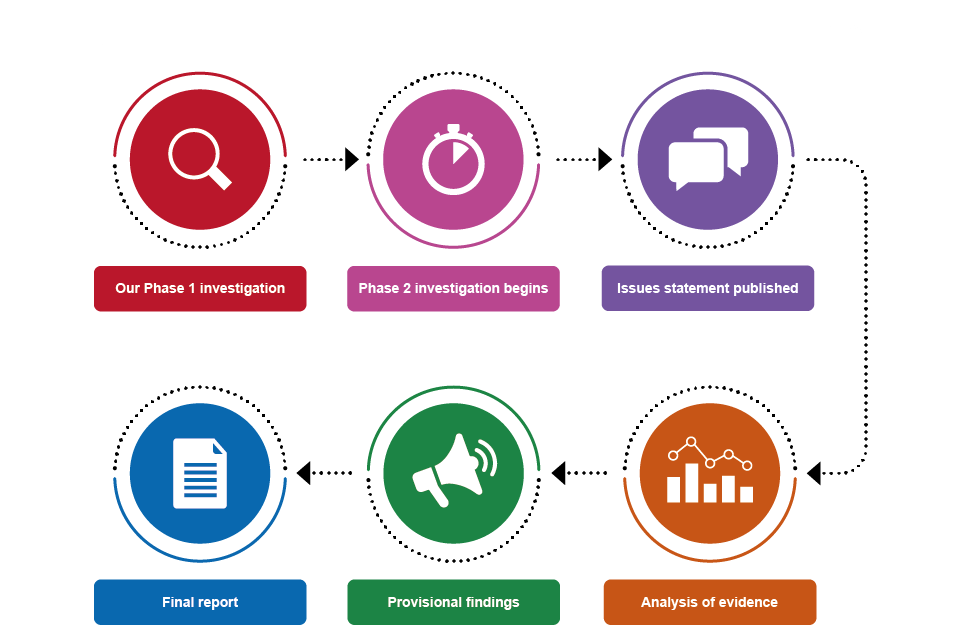

Merger investigations go through the following 6 key stages:

Diagram showing the CMA's merger investigation process. Flow chart which includes: Our Phase 1 investigation, Phase 2 investigation begins, Issues statement published, Analysis of evidence, Provisional findings and Final report.

Our Phase 1 investigation

The CMA first carries out an initial review of the merger to determine whether there is a realistic prospect of a substantial lessening of competition. This is known as our Phase 1 investigation.

If the CMA isn’t concerned about the merger, it clears it. But if there are competition concerns that are not solved following its initial review, the CMA carries out a more in-depth investigation, known as Phase 2.

In this investigation, the CMA completed its Phase 1 investigation in March 2024.

Phase 2 investigation begins

At Phase 2, the CMA will build on the work at Phase 1 and gather more evidence from the merging businesses and others to investigate potential issues with competition that could arise as a result of the merger.

The CMA will meet with the businesses proposing to merge and their representatives ‘on site’ to learn more about their business.

Every Phase 2 inquiry is run by an appointed inquiry group. This is an independent panel made up of 3 to 5 people with a range of business, finance, economic and legal experience. They are responsible for making the final decision on the case.

For Vodafone / Three, the CMA began a Phase 2 investigation in April 2024. The inquiry group was appointed at the same time.

Issues Statement published

The Issues Statement shows the focus of the Phase 2 investigation and sets out what are called ‘theories of harm’, which are the potential concerns being investigated.

At this point anyone, including members of the public, is invited to share their views with the CMA.CMA.

Analysis of evidence

After publishing the Issues Statement, the CMA continues gathering and reviewing evidence. Hearings are held with the main parties (and sometimes third parties) to ask questions about the evidence received and explore key issues.

If the inquiry group thinks the merger could have a negative impact on competition, it will also start thinking about potential solutions to those concerns (known as ‘remedies’).

Provisional findings

Once the inquiry group has a good understanding of the business of the organisations proposing to merge, and a strong evidence base, it will publish the ‘provisional findings’.

This document outlines the provisional decision on the merger.

If there are concerns, the inquiry group will also send the merging businesses its thoughts on possible solutions, in a document referred to as a ‘remedies notice’.

Final report

This includes the final decision on the merger, including whether the inquiry group believes it would harm competition for consumers or businesses in the UK.

- if the inquiry group finds no competition concerns, the merger can go ahead as planned

- if the inquiry group finds that the merger may be expected to result in a substantial lessening of competition, it will decide how its concerns should be

remedied.remedied;Forfor example, this can include selling part of thebusinessbusiness,oraltogetheraltogether, or requiring the companies to commit to take certain actions

Follow the progress of this investigation

For detailed information visit the Vodafone / Three merger inquiry case page.

Updates to this page

Last updated 13 September 2024 + show all updates

-

Update on phase 2 provisional findings added

-

First published.