How we are investigating the Vodafone / Three potential merger

Why the Competition and Markets Authority (CMA) is investigating the potential Vodafone / Three merger and what it might mean for consumers.

Why isare thewe CMA investigating the Vodafone / Three potential merger?

The The CMA investigates investigates the impact of certain potential mergers and assesses how they could impact competition in the UK. This is to promote a fair and competitive environment, where businesses and the UK economy thrive, and consumers can be confident they are getting great choices and fair deals.

Competition can help to keep prices low, as well as provide an important incentive for businesses to improve their services.

What wewe’ve have found so far

In its initial investigation (called a ‘Phase‘phase 1 investigation’) which began in January 2024, the the CMA found found that the merger, which combineswould combine 2 of the 4 mobile network operators in the UK, could lead to a substantial lessening of competition on the basis that mobile customers might face higher prices and a reduction in quality.

This meant that a more detailed (Phase(phase 2) merger inquiry was required.

Provisional findings

On 13 September 2024, the the CMA published published provisional findings on on the Phase 2 investigation.

Theinvestigation where an independent inquiry group has provisionally concluded that:

- that the merger

wouldmight lead to price increases for tens of millions of mobile customers, or see customers get a reduced service such as smaller data packages in theircontracts therecontracts.The

areinquiryconcernsgroupthatfound that:-

higher bills or reduced services would significantly impact those customers least able to afford mobile services

therea

arealsosignificantconcernsabouttheimpactofthemergeronthewho-

the deal could negatively impact ‘wholesale’ telecoms customers such as Sky Mobile and Lebara which rely on the existing 4 network operators to provide their own mobile services

-

the deal would affect these wholesale customers by reducing available network operators to just 3, likely meaning they are less able to secure competitive terms and offer the best deals to retail customers

AtWethenotedsamethattime,However,

theweCMAconsidersthat:considered:- that the merger firm

wouldmight notnecessarilyhavetheincentiveto theCMAalsohasdoubtsastothosethose improvements,improvements,

Remedies working paper

AsOna5result,Novemberthe2024,CMAwehasannouncedprovisionallyourconcludedprovisional view that thedealmergeriscouldlikelygotoaheadleadiftoVodafoneaandsubstantialThreelesseningofferoflegallycompetitionbindingincommitments (known as remedies) that address theUK.concerns outlined in September.WhatThe

happensproposednext?remedies would require Vodafone and Three to:It’s- deliver

importanttheirtojointremembernetworkthatplanthese–arewhichprovisionalsetsfindings.outThetheCMAnetwork upgrade and improvements they willnowmakepubliclythroughconsultsignificantonlevelsitsoffindingsinvestmentandoverexplorethepotentialnextsolutionseight years across the UK - commit to

itsretainconcernscertainbeforeexistingreachingmobileatariffsfinalanddecisiondatabyplansmid-December.forTheatCMAleasthasthreesetyears,outprotectingpotentialmillionssolutionsoftocurrent and future Vodafoneand/ Threeincustomersa(includingremediescustomersnotice.Theseonrangetheir sub-brands) fromlegallyshort-termbindingprice‘investmentrisescommitments’inoverseenthebyearly years of thesectornetworkregulatorplan - commit to pre-agreed prices and

measurescontract terms toprotectensureboththatretailMobilecustomersVirtualandNetworkcustomersOperatorsincantheobtain competitive wholesalemarket,deals

What happens next?

It’s important to

prohibitingremember that this working paper is provisional and themerger.inquiry group is inviting feedback on these proposed remedies by 5pm on 12 November 2024.We’ll publish our final decision before the statutory deadline on 7 December 2024.

How this merger

investigationsinvestigationworkworksMergerTheinvestigationsVodafonego/throughThreethecasefollowingfollows our previous process timeline for phase 2 investigations. In April 2024 we adopted a new process for phase 2.This investigation follows these 6 key stages:

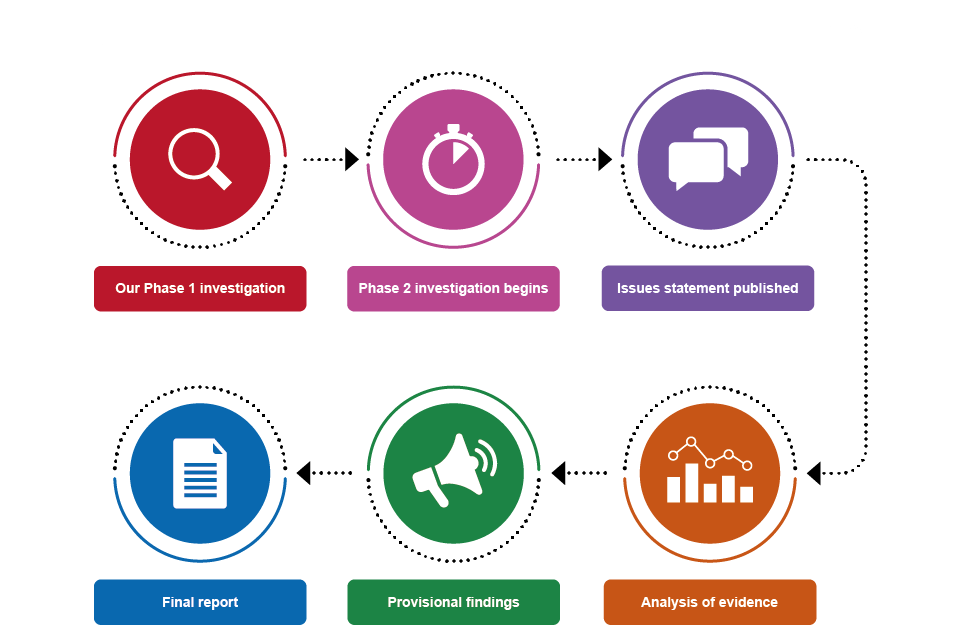

Diagram showing the CMA's merger investigation process. Flow chart which includes: Our Phase 1 investigation, Phase 2 investigation begins, Issues statement published, Analysis of evidence, Provisional findings and Final report.

Our Phase 1 investigation

The CMA first carries out an initial review of the merger to determine whether there is a realistic prospect of a substantial lessening of competition. This is known as our Phase 1 investigation.

If the CMA isn’t concerned about the merger, it clears it. But if there are competition concerns that are not solved following its initial review, the CMA carries out a more in-depth investigation, known as Phase 2.

In this investigation, the CMA completed its Phase 1 investigation in March 2024.

Phase 2 investigation begins

At Phase 2, the CMA will build on the work at Phase 1 and gather more evidence from the merging businesses and others to investigate potential issues with competition that could arise as a result of the merger.

The CMA will meet with the businesses proposing to merge and their representatives ‘on site’ to learn more about their business.

Every Phase 2 inquiry is run by an appointed inquiry group. This is an independent panel made up of 3 to 5 people with a range of business, finance, economic and legal experience. They are responsible for making the final decision on the case.

For Vodafone / Three, the CMA began a Phase 2 investigation in April 2024. The inquiry group was appointed at the same time.

Issues Statement published

The Issues Statement shows the focus of the Phase 2 investigation and sets out what are called ‘theories of harm’, which are the potential concerns being investigated.

At this point anyone, including members of the public, is invited to share their views with the CMA.

Analysis of evidence

After publishing the Issues Statement, the CMA continues gathering and reviewing evidence. Hearings are held with the main parties (and sometimes third parties) to ask questions about the evidence received and explore key issues.

If the inquiry group thinks the merger could have a negative impact on competition, it will also start thinking about potential solutions to those concerns (known as ‘remedies’).

Provisional findings

Once the inquiry group has a good understanding of the business of the organisations proposing to merge, and a strong evidence base, it will publish the ‘provisional findings’.

This document outlines the provisional decision on the merger.

If there are concerns, the inquiry group will also send the merging businesses its thoughts on possible solutions, in a document referred to as a ‘remedies notice’.

Final report

This includes the final decision on the merger, including whether the inquiry group believes it would harm competition for consumers or businesses in the UK.

- if the inquiry group finds no competition concerns, the merger can go ahead as planned

- if the inquiry group finds that the merger may be expected to result in a substantial lessening of competition, it will decide how its concerns should be remedied; for example, this can include selling part of the business, prohibiting the merger altogether, or requiring the companies to commit to take certain actions

Follow the progress of this investigation

For detailed information visit the Vodafone / Three merger inquiry case page.

-

Updates to this page

Last updated

-

Update on remedies working paper published.

-

Update on phase 2 provisional findings added

-

First published.

Update history

2025-06-02 12:00

Updated to reflect case closure.

2024-12-05 07:03

Update on final report published.

2024-11-05 15:31

Update on remedies working paper published.

2024-09-13 07:00

Update on phase 2 provisional findings added

2024-04-29 10:02

First published.